Oman Water Market

Oman`s Water Market Updates

448.78 million m3 Water Supplied

96.03 million m3 Treated effluent production

%22.50 Increase of beneficiaries of treated wastewater services

290,690 Tons of CO2 (GHG) emissions

177.79 Million m3 Water Losses

2.71 Billion USD Estimated Water Projects CAPEX

1.619 Billion USD Estimated Wastewater Projects CAPEX

51% Renewed Water

Whether you are driving change at a utility, designing next-generation technology, or shaping public policy, Oman Water Week 2026 offers a platform to be heard, recognized and connected.

The water and wastewater sectors in Oman are of vital national importance

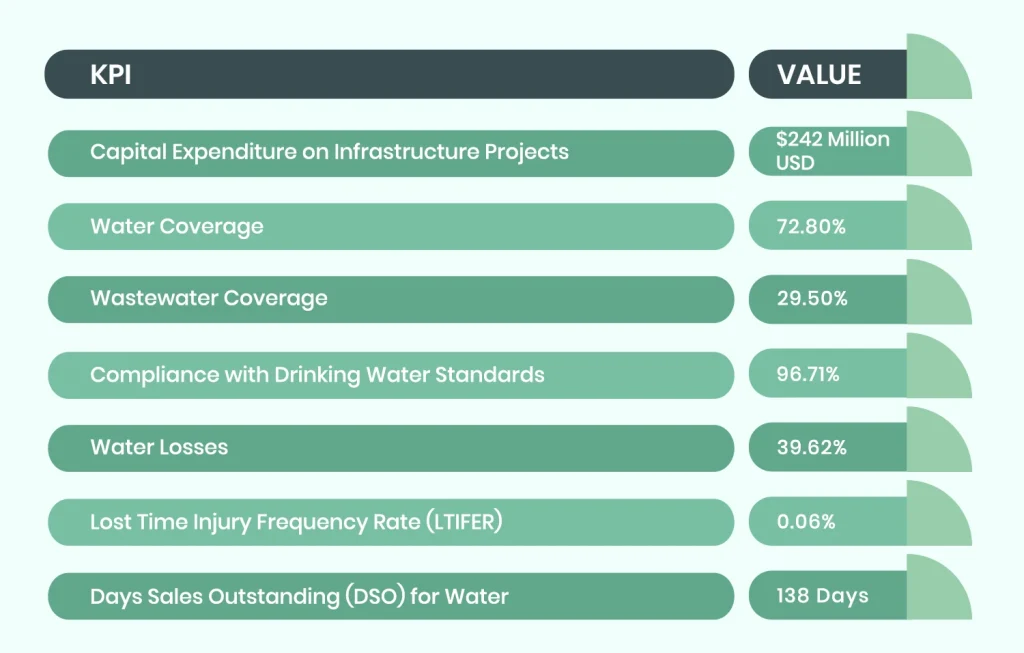

This page is designed to present an informative overview of Oman’s strong water and wastewater sector through data visualization, through graphs and charts that provide at-a-glance understanding of important metrics.

These visual representations highlight Nama’s progress in various areas, including water coverage, financial performance, projects and sustainability initiatives.

Oman's investment roadmap, growth trajectory & strategic priorities in the water sector

Investment & Infrastructure Plans (2025–2050)

- Total Water & Wastewater Investment (2025–2050): USD 29.35 billion

- Water Infrastructure Investment (2025–2050): USD 6.75 billion

- Wastewater & Treated Effluent Investment (2025–2050): USD 22.60 billion

- Planned Wastewater Network Expansion: 21,000 km network

- Planned Wastewater Treatment Expansion: 1.5 million m³/day

- Storage Capacity Projects (Future): USD 880.52 million

- Transmission Upgrade Investment: USD 903.12 million

- Network Rehabilitation: USD 333.77 million

Smart Water & Sustainability Initiatives

- Smart Meter Deployment Target: 734,000 meters

- Prepaid Meters (Target by 2025): 23,000 meters

- Fleet Electrification (Target): 100% transition goal

- Sludge Waste Conversion: Energy recovery from sludge

- Solar Energy Installed Capacity: 23 MW installed

- Emission Reduction Target (by 2030): 32.4% reduction

- CSR Investment in 2024: USD 195.06

Project Delivery & Financial Highlights

- Water Projects Value (2024): USD 240.78 million

- Wastewater Projects Value (2024): USD 28.18 million

Projected Peak Demand Growth – Dhofar (2022–2029): +7% CAGR

Future Desalination & Water Infrastructure Projects

- New Desalination Plants Planned in: Shinas & Musanaah

- Aquifer Storage & Recovery (ASR) Projects to enhance resilience

- Barka IWP Replacement: 100,000–120,000 m³/day (2024)

- Ghubrah III IWP (Under Construction): 300,000 m³/day, COD by 2026

- Wadi Dayqah IWP (Planned): 65,000 m³/day

- Dhofar Water IWP (2027): 68,000 m³/day (may increase to 150,000 m³/day)

Wastewater Expansion Strategy

- Treatment Capacity Expansion Plan: 1.5 million m³/day

- New Wastewater Networks: 21,000 km by 2050

- Sludge Management Upgrades: Anaerobic digestion, composting, incineration

- Treated Effluent (TE) Utilisation Initiatives to support green reuse programs

Sustainability & Net Zero Plans

- Carbon Emission Reduction Target: –32.4% by 2030

- Sludge-to-Energy Conversion Projects Underway

- Solar Capacity Installed: 23 MW

- Fleet Electrification Target: 100% transition to electric vehicles

- Smart Metering Rollout: 734,000 meters targeted across Oman

Energy & Water Synergies

- Renewable Energy Share in Electricity Mix: 11% by 202 to 30% by 2029

- Waste-to-Energy Project (Barka): 130–150 MW, COD by 2028

- Projected Fuel Savings from RE Integration: 3% annually in the MIS/DPS

Regional Water Demand Growth

- MIS Peak Demand Growth (2022–2029): From 1.17 to 1.39 million m³/day

- Sharqiyah Zone Growth: 5% CAGR (145,000 to 196,000 m³/day)

- Dhofar Growth: 7% CAGR (177,000 to 283,000 m³/day)